Crypto Day Trading

The world of digital assets has become popular with many people because they can make a good profit in a relatively short period, and some have even managed to make a fortune that is enough for a prosperous life. Some people got lucky to invest in cryptocurrencies, which later multiplied their deposits by ten or even a hundred times. Others are engaged in medium-term trading, waiting for the right moment to enter and exit the transaction. But some crypto enthusiasts prefer the riskiest method, which requires certain skills in trading and psychological stability.

Let's talk about this method today. We will tell you about the advantages of this type of trading, its drawbacks, what you need to know before you start day trading, and what risks it carries.

What is day trading? What is the difference between it and usual trading?

Day trading is a style of trading in which people who work in prop trading make trades within one working day. In other words, if other traders can open trades that will be closed in a few days, weeks, or even months, then day traders differ from their colleagues in that they close trades on the same day. The trades are manually closed by the trader himself or with the help of his broker (at the trader's request).

Another significant difference between day traders and usual asset traders is that the first ones make more money on the number of transactions they carry out and catch all possible fluctuations, while the last ones prefer to "sit on the fence" and wait for the right moment. For this reason, the number of transactions carried out by a day trader in a day is frequently between 100 and 200. Such a tactic would be impossible for classic traders.

Since the activity of day trading enthusiasts is focused on quick decisions and a high number of transactions, the risk factor is much higher than if a trader were to engage in more moderate trading. However, the higher the risk, the higher the income. In day trading, if you do not follow the rules of money management and risk management, you can double your capital in a few hours or lose it in a few minutes.

The psychological aspect

The right psychological resilience is required for appropriate day trading. It is also necessary in usual asset trading, including cryptocurrencies, but the need for a strong mental state is even more vital in the case of daily trades. Many traders say that the majority of trades are closed at a loss but the trades that are closed positively cover the loss-making trades and allow them to make a profit. While the trader will inevitably see his unprofitable trades, he needs to stay cool and not get depressed, so a clear mind helps him to make the right decisions.

Day traders can feel special pressure from the market if they use the “scalping” strategy, about which we will talk later. The situation can be more gentle in other cases.

How much do day traders earn?

This is a good question, which can be asked by many people who have heard about day trading and are interested in how much such crypto traders earn. There is no clear answer. The results of the earned profit can vary from -100% to +1000% and more, however, as we said earlier, it depends on the psychological preparation and the style of trading.

If we consider more stable examples of trading, we will be able to narrow the range of monthly earnings to 10-20% in this case. There are articles, which say that real professionals risk so little that their income is below 3-5% or even 1-2%. In this case, there is a question “how big are the deposits these traders have, how relatively little is their earning, and the main thing is how profitable is this business in their case?”.

Monitoring the activity of various traders and talking with different people, we have concluded that if you make 10-20% of a deposit per month, it is a nice and acceptable result, which is in an excellent range between high risks with losses and too low risks with low profit.

On one hand, earning 10% a month is not that much, especially if we take a look at how the cryptocurrency world spent January and how many percent of profit it brought to some investors and traders who used derivative financial tools.

Nevertheless, if the investor learns to make stable profitable trades and reaches a stable 10% of deposit per month, he will be able to multiply his initial deposit by 28,5 times in the long term if he trades the whole year and does not withdraw.

In such a way, if you can learn to trade and begin earning regularly, you will be able to make the sum of your initial deposit monthly for two years after the start of trading. And this is all taking into account the fact that this is 10% of the deposit. A certain part of traders can earn 15%, or even 20%, and 30% of deposits in especially successful months but it is already high risk.

What is required for day trading?

To start your road in day trading, you will need to create an account on any cryptocurrency exchange first, after which you will need to complete the KYC (Know Your Customer) process. Such authorization will allow you to deposit money on an exchange and start trading.

If you are new to the trading sphere, we would recommend you avoid trading with large sums because you will not be able to make a profit at first. The start of trading should make you get used to small losses psychologically and learn how to stay cool, after which you will be able to make more successful trades with a clear mind and earn profits.

If you have ever tried forex trading and traded with the help of a demo account without going beyond it, this type of “trading” has nothing similar to trading for real money. The emotional and psychological components of trading with a demo account and real money will differ a lot.

The process of trading

So let’s talk about the most interesting thing, namely, how you can trade during one working day in the cryptocurrency sphere. The digital asset market differs from the ordinary financial one by a pretty high volatility. Day trading differs from long-term trades in the same way. Consequently, trading in crypto in one day can be called twice as volatile, so it is a pretty unstable business.

To catch the right moments, in which you should enter the trade, it is worth using various financial tools and trade pairs, which you will prefer using.

It is the best to trade such pairs as BTC/USDT (or any other stablecoin, which is connected to the US dollar), ETH/USDT, XRP/USDT, BNB/USDT, and other famous and more or less stable cryptocurrencies. Nevertheless, there is no big difference between the majority of them because they are pretty similar and almost always follow Bitcoin’s movements. To avoid being tedious, we propose you take a look at the Bitcoin movement chart (above) and various cryptocurrencies, including Ethereum, BNB, Dogecoin, and others.

In such a case, you will have a logical question “What is the difference between what assets to trade if they move similarly?”. The answer is that various digital assets can face different events, which will make them deviate from usual fluctuations and, depending on the events, increase or drop the price.

We will talk in detail about this in the “News trading” section

Regarding ordinary trading with the use of financial tools, you should take a look at Bitcoin, which is traded by millions of people from all over the world. The capitalization of the flagship digital asset is more than $420,000,000,000 and the trading volume exceeds the mark of $18,700,000,000. It reflects that this digital asset is chosen for a reason and it is better to stick to the part of the audience that knows what it does in this case.

Risk management and money management

These two components are necessary to reduce the risks of losing the day traders’ financial resources of day traders. Without following these rules, people, of course, can multiply their deposit by 2 times in a few minutes but they can lose all their money at the same time.

The most widespread rules of risk management and money management are that the number of funds invested in one transaction should not exceed 1-3%. For newcomers, this rule can sound like “less is better”. If we assume that the inexperienced trader makes 30 successful trades out of 100 per day, it will bring zero profit in the long term.

Talking about particular examples, if your deposit is $1000, you should not use more than $10 for your trades at the beginning of trading.

Money management will also allow us to understand what sum a trader is ready to lose if the price moves in the direction the trader did not want and risk management will allow him to not exceed the predetermined threshold. Also, risk management shows the proportion between how much a trader can earn and lose. The most popular practice is the ratio of 1:2, 1:3, and 1:5 in some cases.

Let’s take a certain example once again. The trader has found an entry point in the BTC/USDT trading pair and enters with 1% of his deposit at the moment when BTC/USDT is at $20,000. To enhance the effect, he takes a leverage of 1:100, which doubles his $10 if the price moves 1% up and liquidates the position if it drops 1%. It is worth noting that it is important to choose an isolated type of liquidity in this step so that, in addition to this $10, the exchange does not influence another part of your deposit in case of movement in the wrong direction.

If we choose the ratio of 1:1, the trader’s deal will close at the mark of $20,200 or $19,800 with a profit of 100% or a loss of 100% from the invested $10, respectively. If the trader uses the 1:2 strategy, he will have to fix the profit at $20,400. If it is 1:3, he should stop at $20,600.

The proportions are taken for the sake of clarity. In scalping, movements should be shorter because Bitcoin can not increase by 1% per day and a day trader will not realize a single trade in the whole day, which would be contrary to this concept.

Trading strategies

Scalping

In day trading, scalping is one of the main strategies for people who trade daily. At the same time, it is one of the most aggressive methods of money making. When ordinary traders enter the trades and wait for the upward movement by a few percent to one or another direction, scalpers, in their turn, can open many trades and close them once the price deviates only by a few points.

For example, a regular trader enters a $20,000 BTC/USDT trade and goes long. When the price reaches $20,600, he closes it and gets a 3% profit. A scalping day trader, on the other hand, can open a trade for $20,000 and close it when the price reaches $20,020, which is only 0.1% of the move.

To increase revenue and cover a commission, he will need to use big credit leverages, which is a reason for a high risk of such an activity. As we said previously, the situation when the number of such trades is more than 100 and reaches 200 per 1 trading day is a pretty usual thing.

To identify a good entrance point, you will need to use technical analysis, which allows you to understand the right moment to enter the trade. It is worth understanding that technical analysis does not guarantee success but it increases its chances significantly.

If a trader does not have a clear strategy and does use logic while opening or closing one or another trade, this process will not differ from a simple bet on “red” and “black” in a casino. The only difference is that the chance to have red and black in the roulette is equal to 48,65% and the chance to predict the market moving upward or backward is 50%, which is 1,35% higher than the roulette.

It is worth noting that since morning marks very high volatility, those who start their road in day trading and scalping should avoid the trades made in the first hours of market opening and wait for a more stable situation.

Technical analysis

In general, the topic of technical analysis is big enough and if you ask any experienced trader if they have been able to thoroughly learn technical analysis, they will most likely answer “no”. You can learn financial tools during your whole life because the market is constantly developing and the new situation a trader has not faced may appear.

Nevertheless, we will talk about the things that will be useful for trading both in scalping and other types of trading.

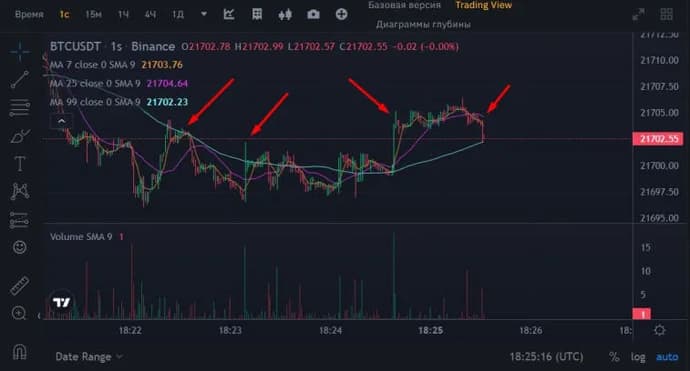

Trading by levels/ Channel trading

To find good entry points in scalping trades, you will need to choose a low timeframe, which displays what is happening on the market right now. The timeframe of 1s or 1m would suit the best, in which peaks will show the actions over the last second or minute, respectively.

After that, It is necessary to highlight local levels, which will show the limits the price of the asset has not surpassed recently. In such a way, we will be able to find places from which quotes will most likely bounce off and go in the opposite direction. This is because traders working for the exchanges, in turn, also determined the levels and set buy and sell orders.

For example, the screenshot below displays that we have found four spots, which create the approximate level that buyers did not surpass over the last minute. As a result, we can conclude that the level of $21,005 is a local resistance point. Consequently, scalpers can consider this a signal to enter shorts (an order for selling).

When the price reached the level assumed by us, it was a good moment to try to open a trade down, since it bounced off this zone several times (the 4th arrow).

In the next screenshot, we can see that our assumptions were right and the price, having reached that level, started falling and when it dropped by 25 points, we were able to close the trade and make a profit.

Trend trading

Opening the chart, we can see one of three situations: side movement, upward movement, and downward movement. Channel trading is possible only when we can detect that the price bounces off the so-called levels and does not display a clearly defined side of the movement. But what should you do when the price is moving only in one direction? In this case, it is worth highlighting the movement of a coin and monitoring its character. Thus, we can find an approximate good point to enter a trade by following the trend to follow the market.

In the screenshot, we can see how Bitcoin has moved recently and, despite it falling mostly, there was a local correction from time to time.

It would be good to try to open a short deal in the spot of the fourth arrow and realize another profitable trade.

This tactic can be used both in a downward and upward trend.

Trading against the trend

Such a strategy is fully opposite to the previous one and has the opposite logic. When the market moves in one direction whether it is short term or a more global level, it is obvious that it will change its direction sooner or later and start moving oppositely. This tactic has a lot of risks but some traders use this argument, opening the trades against the trend, and they appear to be right from time to time.

Financial tools

There are many ways to find the right moments to enter a trade and you can learn new tools and improve your skills forever. But tend trading and trading by levels are pretty simple but still working methods to start your path of trading.

Various indicators can help you with this, including RSI (relative strength indicators), Bollinger waves, MACD (trend strength indicator), OBV (position volume flow indicator), and others. The use of these indicators and their application in practice is a topic for a standalone article, which is difficult to explain in a few words.

News trading

News trading can also be a very effective weapon for day traders, although it does not include technical analysis. The scheme of news trading is pretty simple. Cryptocurrency fans should follow the economic calendar and keep up with events, which impact not just the world of the financial market but the industry of digital assets.

The line between these spheres has disappeared and many experts from the world of cryptocurrencies always follow the events in the financial market. As it was mentioned by analysts, experts, and simple traders, it influences the price of Bitcoin directly in one or another way.

When the USA talks about the negative numbers regarding the level of inflation, unemployment, or interest rate, this has a positive effect on BTC with stablecoins. Why? Because investors begin exchanging their financial resources from Bitcoin to the US dollar to protect their savings.

The opposite is also right. When the US Federal Reserve announces the positive changes to the dollar, investors start to transfer their savings to the dollar, which negatively affects bitcoin paired with dollar stablecoins. This is because investors are starting to choose the dollar as a tool to save their money.

Thus, day traders can also use this knowledge to make trades. For example, if the announcement of interest rate by the US Federal Reserve is expected to happen at 15:30, you should prepare for Bitcoin to go up or down at this moment. And it works. This is true even in the short term. The main thing is to be ready for changes and see the direction in which the market will start moving.

It is also worth understanding that there are different news and the level of their influence on the market varies too. This indicator should also be considered while overviewing the financial news for the upcoming week or trading day. The level of influence is always reflected in economic calendars and only in the cases when the news has the highest level of effect in the financial market.

It is also worth following the events, which happen directly in the cryptocurrency world. Last year showed that if you notice a warning sign about some cryptocurrency exchange, you will be able to make a fortune in the short term, having opened a respective trade.

Futures fans had, at least, 2 such moments: in May and October. In the first case, they saw the collapse of Terraform Labs and its infamous LUNA token. In the second case, we observed the collapse of the American cryptocurrency exchange FTX. Traders who managed to open shorts on time and used large leverage could not only earn their annual salary in less than an hour but also receive so much money for 1 transaction that they could be enough for a comfortable rest of their lives. In other words, you must not neglect the information field and keep up to date, and if this event repeats, you will be able to make a deal that, without exaggeration, will change your life.

The advantages and drawbacks of day trading

The advantages

- The main advantage of crypto day trading is the absence of dependence on the global position of the cryptocurrency market. For example, traders who trade daily and limit only within a single day will not worry about how high or low Bitcoin is. The last one will be dealt with by investors, especially those who entered high positions. It does not matter for day traders whether Bitcoin costs $22,000 or $100,000. They are trading on differences here and now and they do not need to wait for months and years to close a good trade.

- The second advantage can be called a fairly low threshold for entering a position. In long-term trading and swing trading, there are five-figure and sometimes six-figure deposits at high levels, but things become more casual when it comes to day trading. People can collect a good amount for a stable income in daily trading in six months or less and try their hand at this business, after which they can raise the deposit in a year or two to a good level and have a stable good income from this. If a person does not like this type of activity or he loses his money, then, in this case, the loss will not be as big as when working with more substantial amounts, which should also be called a huge plus.

- The third advantage of day trading is a relatively quick result. Representatives of the financial market and crypto market traders who work on long-term trades and swing trading do not know the result for days and months. Day traders, in turn, see the result of their work on the outcome of their trading sessions and can analyze their trades, make a summary, and work on mistakes, which will lead to better results if the used approach is right.

- The ability to adapt to the market quickly can be considered the fourth advantage. If a person who works in middle or long-term trading enters a position and the price moves in the wrong direction, he will have nothing to do but wait for the mandatory end of the trade. In the case of day trading, if the price goes the wrong way, then the stop loss will work and the loss will not be as noticeable as in the case of swing traders, and you can change your strategy.

The drawbacks

- The first and main drawback of day trading is the psychological and emotional condition of a trader. It is worth understanding in the case of this type of trading that the advantage in the form of constant market adaptation can be a drawback for a trader simultaneously. The requirement of constant attention and adaptation to the situation requires a lot of time and nerves, and when several transactions in a row are closed at a loss, then the person involved in trading may experience moral pressure. It is also worth noting that for successful trading in such a business, as a rule, a large number of transactions are necessary, which can mostly become unprofitable. Consequently, working in this type of trading requires a lot of effort.

- Although we just mentioned a big waste of time a minute earlier, we will still take this drawback into a separate point of drawbacks. To conduct successful trading every day, you need to spend a lot of time. We talked about the fact that every day trader should be aware of events taking place not only in the world of cryptocurrency but also in the financial industry. For this reason, such traders should monitor events every day and spend their time waiting for good points to enter a trade.

- The third significant drawback in day trading is a pretty high commission due to the specificity of day trading. When a person opens and closes a big number of trades in a signal day, it faces large commissions, which are taken by the cryptocurrency broker. In this case, he makes money but loses a certain part due to the commission. Depending on the success of the trader’s activity and the number of positive trades, the sum of the commission varies but the real fact is that it reduces your profit.

- The fourth drawback of this type of trading is the high risks. Although the world of cryptocurrencies is a pretty risky place, in which you should not expect something concrete, day trading has a higher risk. This means that a person must necessarily have a stable psyche in this type of trading. Otherwise, he may lose a significant amount of money, and maybe even the entire deposit. To achieve stable results, traders should have strong psychological stability, which reduces the ranks of successful cryptocurrency traders a lot.

Who is suitable for day trading?

You may ask a question after such drawbacks: “Should I work in such a type of activity if it is pretty risky?”. This question can be answered if you understand how psychologically strong you are and if you can self-learn.

Day trading is a difficult business and it requires regular analysis of the situation, mistake fixing, adaptation to new circumstances, and psychological resilience because not every trader can close a few trades at a loss, stay calm and act by his strategy, not emotions.

If you are honest with yourself and understand that you are prone to impulsive and not the most rational actions, you should think better about swing trading or long-term trading or even investing. However, if you know that you have such characteristics as stress resistance, self-control in difficult situations, and discipline, day trading might become your way of making money. While you use your strong qualities, those who do not have these will lose money on the cryptocurrency market.

Bogdan Lashchenko - innehållschef på EgamersWorld.Bogdan har arbetat på EGamersWorld sedan 2023. När han gick med i företaget började han fylla webbplatsen med information, nyheter och evenemang.

Roblox Anime Guardians-koder februari 2026Upptäck alla fungerande Roblox Anime Guardians-koder. Lös in för gratis Mystic Coins, Trait Rerolls, Artefakter och belöningar.

Roblox Anime Guardians-koder februari 2026Upptäck alla fungerande Roblox Anime Guardians-koder. Lös in för gratis Mystic Coins, Trait Rerolls, Artefakter och belöningar. Onlinekasinon utanför Storbritannien: Spel, format och vad spelare kan förvänta sigOnlinekasinon som verkar utanför det brittiska spelramverket uppmärksammas på grund av skillnader i licensmodeller, spelportföljer och marknadsföring.

Onlinekasinon utanför Storbritannien: Spel, format och vad spelare kan förvänta sigOnlinekasinon som verkar utanför det brittiska spelramverket uppmärksammas på grund av skillnader i licensmodeller, spelportföljer och marknadsföring. Bitcoin-kasinon och kryptospelsplattformar för brittiska spelareKryptobaserade spelplattformar har blivit ett märkbart segment av den globala onlinekasinomarknaden.

Bitcoin-kasinon och kryptospelsplattformar för brittiska spelareKryptobaserade spelplattformar har blivit ett märkbart segment av den globala onlinekasinomarknaden. Bästa internationella onlinekasinon för brittiska spelareOnlinekasinobranschen är en ständigt växande sektor som är erkänd för sin teknik, sitt omfattande spelbibliotek och den mängd intäkter som den genererar...

Bästa internationella onlinekasinon för brittiska spelareOnlinekasinobranschen är en ständigt växande sektor som är erkänd för sin teknik, sitt omfattande spelbibliotek och den mängd intäkter som den genererar...